There’s a big misconception that high school students can’t prepare or do anything to set themselves up for financial security in the future. Being under 18 gives many a false sense of helplessness because they are not technically adults yet, which isn’t true. I’m going to show you what you can do from your first-year student year through senior year.

In your first-year student year, at the age of 14, your options may be limited but not empty. From this age, it’s important to learn and implement the 50-30-20 rule. The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to achieve your future goals. However, as a 14-year-old, you don’t have many needs because you’re still living with your parents, so I recommend allocating 60% towards savings, 20% towards wants, and 20% towards needs. This concept is echoed by American radio show host, author, and personal financial guru Dave Ramsey, who says to “Act your wage, even in high school. Learn to live within your means, save for your goals, and develop the financial habits that will set you up for success.”

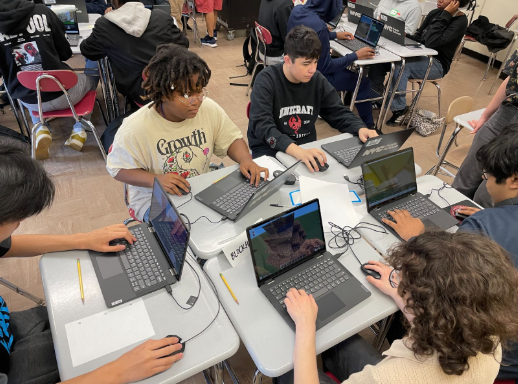

During your first-year student and sophomore years, you should find side hustles like babysitting, selling candy, lawn care, and more to make some money. Many others work for their relatives since they can’t have a real part-time job. This is all preparation to get you used to saving and working later on.

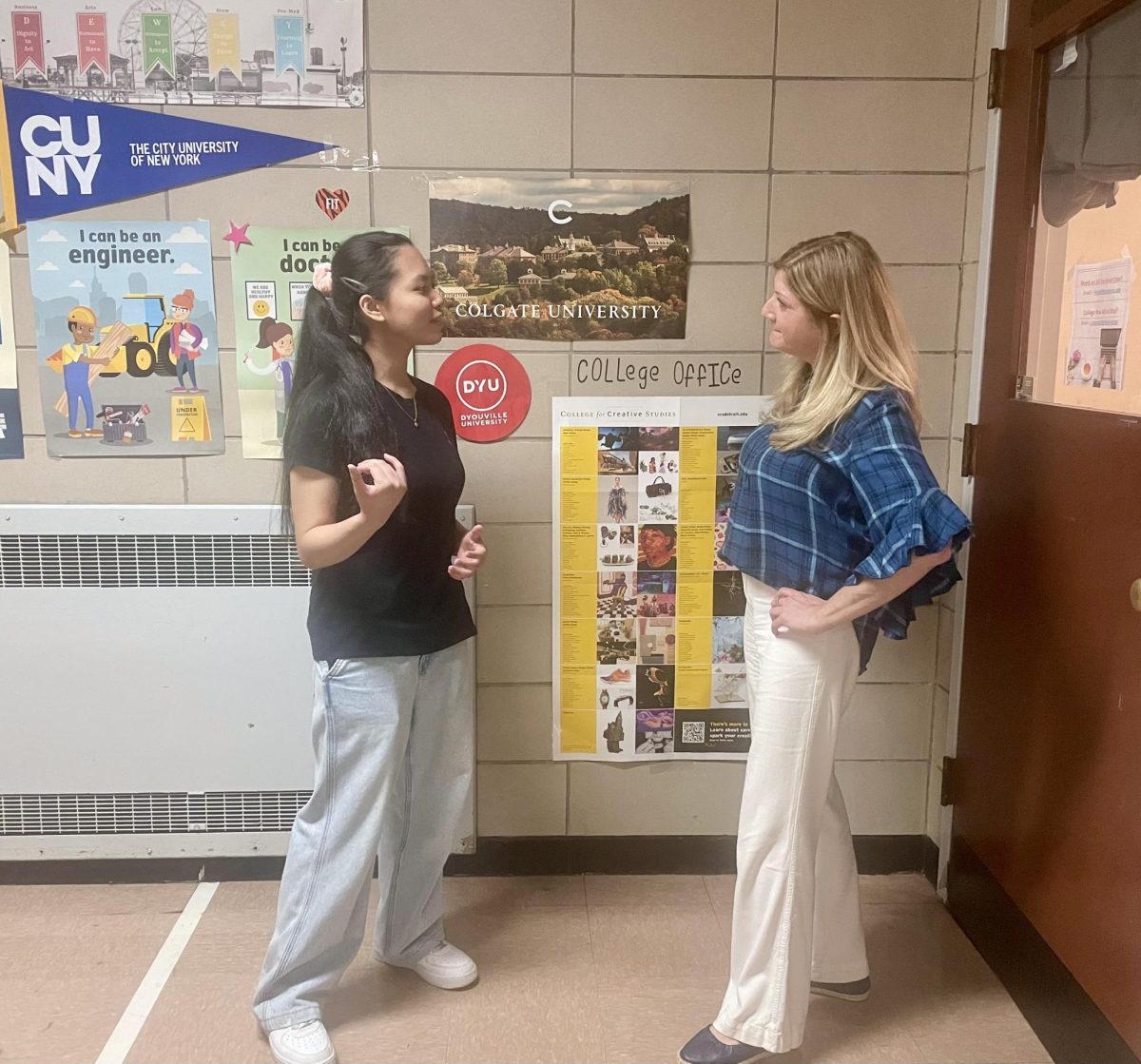

The most important time is during your junior and senior years. Get your work papers and license. This is when you should get a high school bank account and learn about credit and savings accounts. When you turn 18, sign up for your first credit card and spend it only on groceries and small things while paying off the balance every month to avoid incurring interest. This will help raise your credit score, enabling you to take loans with low interest rates. According to economics teacher Mr. Danticat, “You should have your parents add you to their credit card at 16 and start at a young age because the two most important things for credit is your credit history and credit usage.”

This is also when you should open a high-yield savings account and deposit a set amount of savings every month. I personally recommend a Roth IRA. The Roth IRA is an Individual Retirement Account to which you contribute after-tax dollars. Your contributions and earnings can grow tax-free, and you can withdraw them tax-free and penalty-free after age 59½ and once the account has been open for five years. If you contribute $5,000 per year to a Roth IRA and earn an average annual return of 10 percent, your account balance will be worth a figure in the region of $250,000 after 20 years. Imagine it keeps recurring until you’re 60.

During this time, other than working a job, learning about investments like mutual funds, the stock market, bonds, and real estate is important. Investing is an effective way to put your money to work and potentially build wealth, which has its own risks. Smart investing may allow your money to outpace inflation and increase in value, earning you passive income. The greater growth potential of investing is primarily due to the power of compounding and the risk-return tradeoff. Benjamin Graham, a British-born American economist, professor, and investor, who is often referred to as the ‘father of value investing’, offers financial insight for teens, saying “High school students, be patient in your financial decisions. Understand the risks and rewards of investments, and focus on the long-term gains.”

There are many choices for what you can do with your money, but you should “never put all your eggs in one basket,” which means to risk all you have on the success or failure of one thing. Investors like you should diversify their investments so one unfortunate event won’t cripple your entire financial security. Senior Mukhammadali Alijonov discusses how he interprets this strategy with his finances, saying “I started investing in blue-chip stocks and cryptocurrencies, and my biggest advice to you is to always be patient and not panic sell.”

Breaking free from the misconception that financial preparation is only for adults, high school students can actively pave the way for their future stability. From understanding budgeting principles and engaging in early side hustles to opening credit cards and savings accounts, the journey follows you through your high school years. Embracing investment knowledge and diversifying financial portfolios further strengthens the foundation for sustained growth and security.