Planning for college can be overwhelming, especially when it comes to figuring out how to pay for it. The Free Application for Federal Student Aid, or FAFSA, is a crucial tool in unlocking financial aid opportunities for college students. But what exactly is FAFSA, and how does it work? Here’s a comprehensive guide to understanding FAFSA, financial aid, and the steps you need to take to make college more affordable.

What Is FAFSA?

FAFSA is the gateway to federal financial aid, including grants, loans, and work-study programs. Submitting the FAFSA is essential for all students, as it helps colleges determine your eligibility for financial support based on family income.

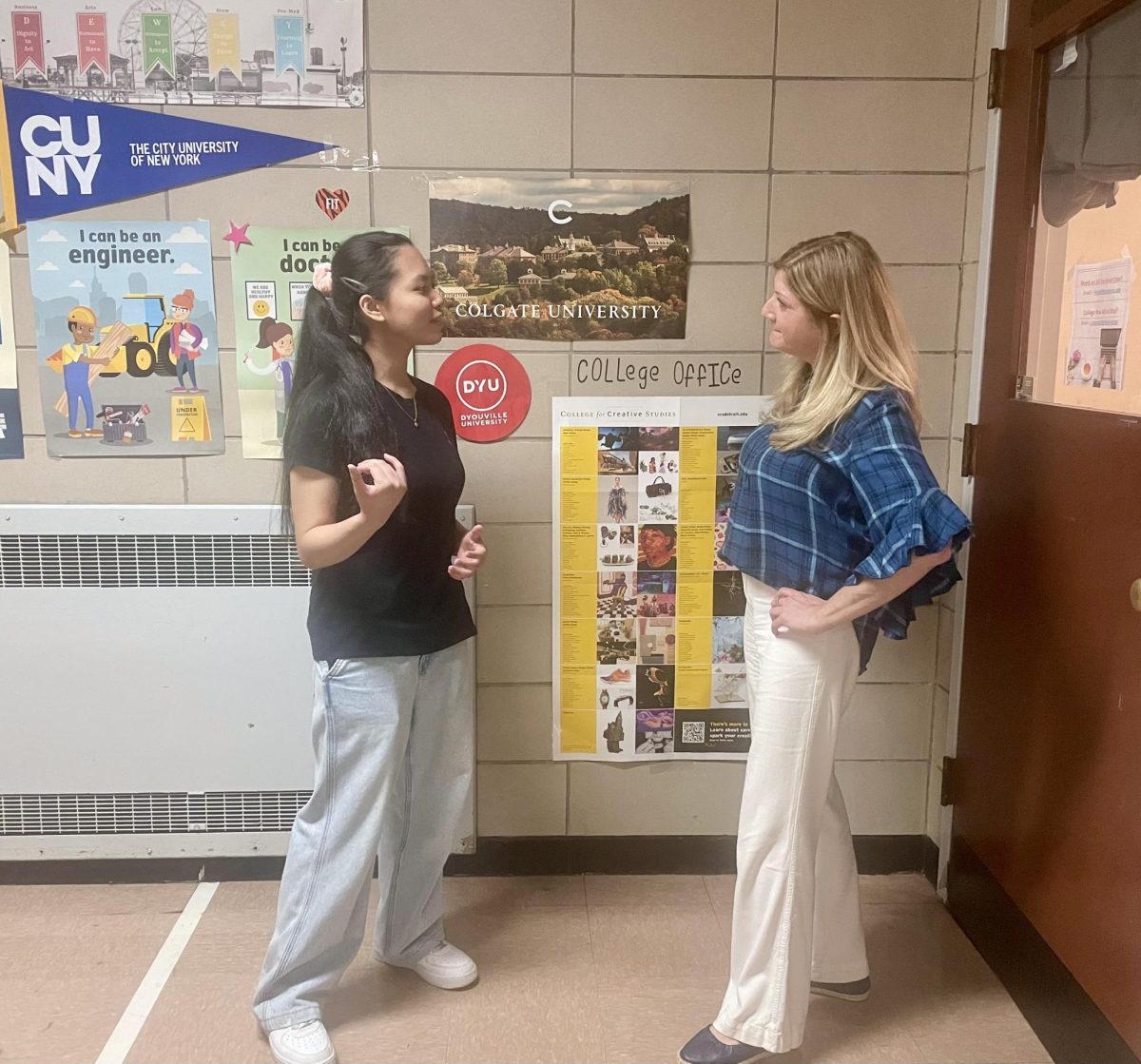

Linda Mazzola, a college counselor at John Dewey High School, emphasizes the importance of FAFSA:

“All colleges will require students to complete the FAFSA regardless of income level. The cost of attendance and the income earned helps to determine the amount of aid a student will qualify for. Because FAFSA is needs-based aid, those from lower-income families with a greater financial need get access to more financial aid.”

Steps to Tackle FAFSA

Although FAFSA might seem intimidating, preparation can simplify the process. Here are key steps to get you started:

- Create Unique Accounts

“FAFSA is not difficult to complete,” he also said “One key to successfully completing the FAFSA is to have the student and parent/legal guardian create a separate username and password.” – Said Ismael Casarez (student at JDHS)

- Organize Your Documents

Gather your 2023 tax records, W-2 forms, and any other financial documentation beforehand. Accurate information is vital for a smooth application process.

- Submit Early

FAFSA opened on December 1st this year. Applying early maximizes your chances of receiving aid, as some funding is limited and awarded on a first-come, first-served basis.

FAFSA vs. TAP: What’s the Difference?

It’s important to understand that FAFSA and the New York Tuition Assistance Program (TAP) are not the same.

“TAP and FAFSA are NOT the same. FAFSA can be used for students and colleges assistance in all different states, but TAP or Tuition Assistance Program can only be used by a student/resident of NY who attends a New York college,” explained Ms. Wolkoff (C/O College Counselor)

TAP is a state-based financial aid program for New York residents, and completing the FAFSA is a prerequisite for applying. “You will need the IT-201 Tax Document to complete the TAP application. TAP cannot be completed until AFTER FAFSA is submitted,” Ms. Wollkoff advises.

Types of Financial Aid Available

Filing the FAFSA opens doors to various forms of aid, including:

- Grants: Free money, such as the Pell Grant, which doesn’t require repayment.

- Federal Loans: Low-interest loans with favorable repayment terms.

- Work-Study Programs: Part-time jobs that help students earn money while studying.

In addition to FAFSA, scholarships can significantly reduce the financial burden.

“Although applying for scholarships requires effort, the payoff is worth it because they don’t need to be repaid.” said Ms. Mazzola

Is Financial Aid Enough?

The million-dollar question is whether financial aid alone can cover all college costs. Wolkoff notes that the answer varies:

“There is no hard answer when addressing if financial aid is enough to pay off college tuition,” also “I have been doing this job a long time, and I have seen some students receive a lot of aid and others receive none. The lower the income at home can help you with receiving more financial aid.”

Final Thoughts

The key to maximizing financial aid lies in preparation, early application, and exploring all available options. Whether it’s grants, loans, work-study, or scholarships, a proactive approach can make college more accessible.

For additional support, students at John Dewey High School can visit the College Office for personalized guidance. With the right resources and determination, affording college is within reach.